Immediate Impact on Cashflow

Your cash flow may be about to become tighter. If you are registered for CIS and VAT new rules surrounding how you invoice your customers will mean that you will continue to pay out VAT on materials but not reclaim it for up to 18 weeks, then you may have to wait even longer for HMRC to make the refund.

New Rules

New rules about VAT within the construction industry come into effect in October 2019.

From 1 October if you carry out construction work for a VAT registered contractor you will not charge them VAT. This could appear to be a good thing, but the impact on your cashflow could be quite significant; instead of receiving £1,200 you will be receiving £1,000 and you will still have to fund the VAT on any materials you purchase and sell on.

Example

|

|

Current |

After Oct 19 |

|

|

Invoice Amount Labour |

£1,000 |

£1,000 |

|

|

Invoice Amount Materials |

£1,000 |

£1,000 |

|

|

VAT Charged |

£400 |

Nil |

|

|

Received from customer |

£2,400 |

£2,000 |

|

|

Purchase of Material |

£1,000 |

£1,000 |

|

|

VAT Paid on Materials |

£200 |

£200 |

Amount you will have to fund |

|

Paid to supplier |

£1,200 |

£1,200 |

|

|

Cash Position |

£1,200 |

£800 |

£400 |

The good news is that you can alleviate this impact by completing VAT returns monthly instead of quarterly but before you decide whether this is a good idea for you, ask your accountant to outline the cashflow benefit against any additional costs; this will be unique to your circumstances.

Additional Administration

You will be required to identify the VAT status of your customer and verify them through the CIS scheme; we recommend you maintain records of their VAT Number and Company UTR. These checks are your responsibility!

And even though you will not be charging VAT, you will still have to show the amount of VAT your customer must declare as a “Reverse Charge” on your invoice – get redesigning!

I am aware of larger contracting companies warning their subcontractors to ensure they prepare their invoices correctly or risk further delays in payment, a situation that everyone wants to avoid.

Businesses that currently report VAT under the “Cash Accounting” scheme will not be able to do so when the new rules come into effect. These businesses will have to change the way in which their reporting, and paying over, of VAT is done. And remember that if you complete your VAT returns incorrectly you are liable for fines and penalties from HMRC.

End Users

If you are supplying to the end user of the building in question these rules do not apply and you will charge VAT as you have been doing at either 5% or 20%. In these circumstances it is your responsibility to adequately confirm that your customer is the end user.

Software

We have all recently had to adapt to the Making Tax Digital initiative from HMRC. Many businesses have invested in proprietary software to make this easier. You should check that any software you have installed is capable of handling these reverse charge transactions.

In Conclusion

Whilst these new rules could seem a little onerous for the smaller construction company, the intention behind them is to level the playing field by stopping unscrupulous businesses avoiding the taxes that the rest of us pay. Yes, you good guys take the initial hit for all the years of tax avoidance and company phoenixing” shenanigans of others.

Whilst these changes will cause a little pain until they bed in and we all become accustomed to them, let’s hope that the ambition behind them is realised. In the long run competing on equal terms can only be a positive improvement.

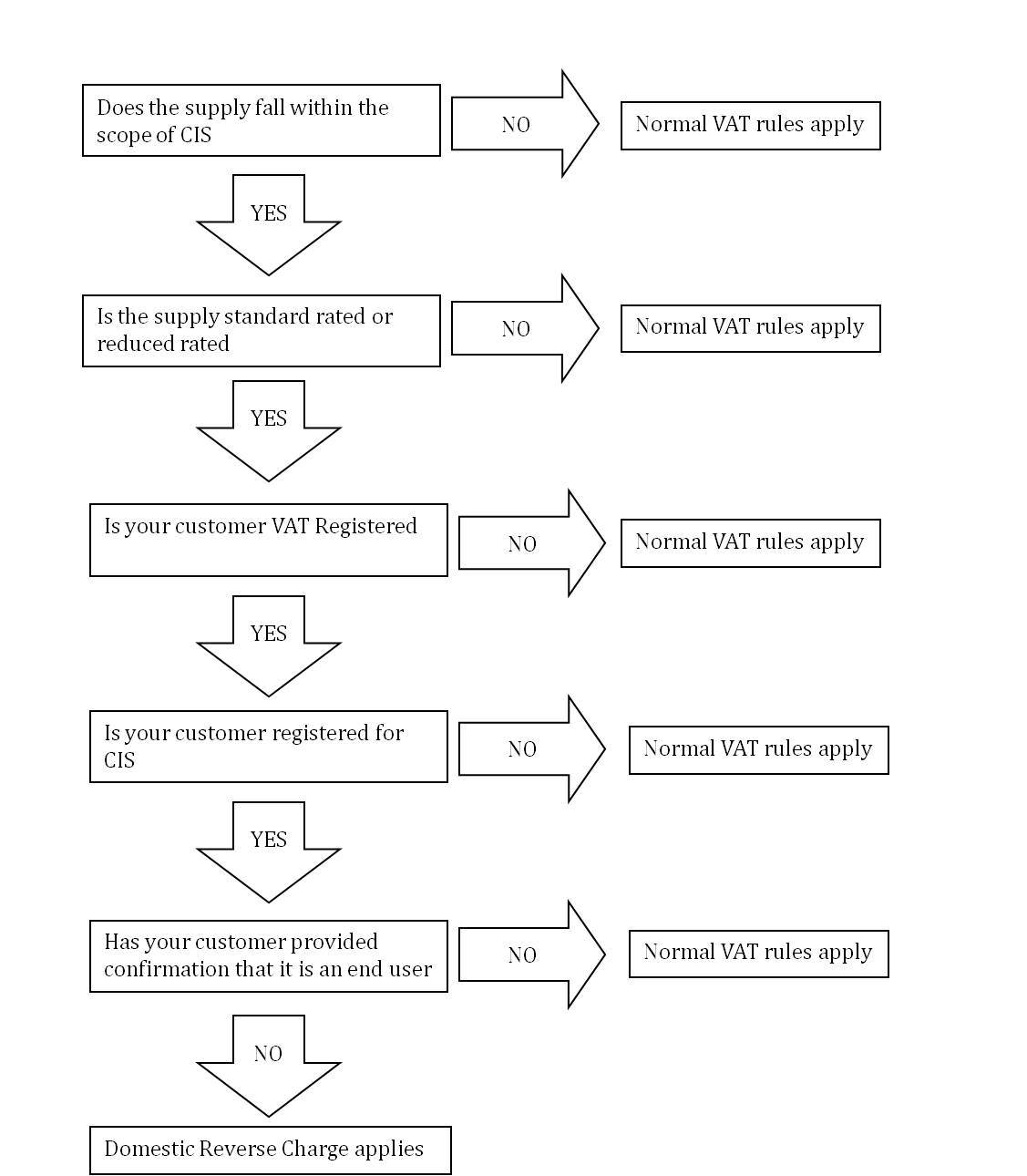

HMRC have published the flow chart below that identifies the exact treatment of each invoice you raise, I hope it helps.

If you would like to discuss the contents of this article in more depth please call us to arrange a free consultation.

HMRC’s Flow Chart